College savings for every future

Understanding 529 plans and their benefits

Give the gift of knowledge, career skills and life-changing opportunities to an eligible beneficiary—in the form of a tax-advantaged, benefits-oriented college savings account that can be used for a variety of qualified educational expenses.

What is a 529 plan?

Kick-start your college fund with an account that’s flexible, simple to manage and grows tax-deferred!

A tax-advantaged way to save for college and other educational expenses

Can be opened with only $25 and 15 minutes of your time

What can an MESP account do for me?

Tax-advantaged growth potential

With an MESP account, you could save more with tax-deferred growth and 100% tax-free earnings for qualified withdrawals. Michigan taxpayers can also reduce their state taxable income up to $10,000 per year. When you pay less taxes, you have the ability to earn more and grow your college savings account faster—giving your beneficiary an even bigger head start!

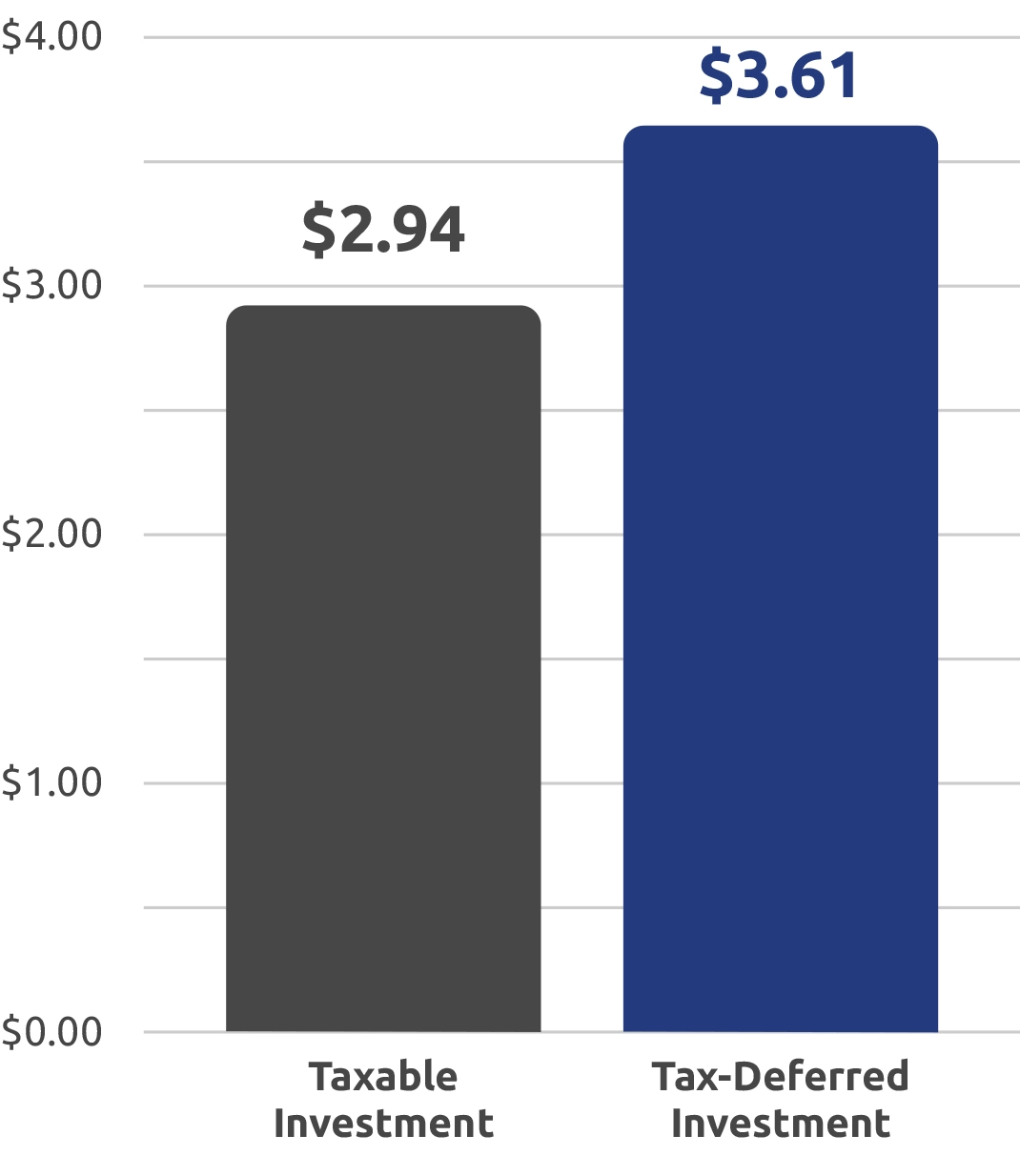

With tax-deferred growth, you can grow your college savings faster.

Taxable vs. Tax-Deferred growth over 10 years.*

- Taxable Investment

- $179.64

- Tax-Deferred Investment

- $210.61

Read about material differences between taxable investments and tax-deferred investments.

Graph Footnotes

- *Index performance data shown represents past performance and does not predict or guarantee future results. You cannot invest directly in any index. Index returns do not reflect a deduction for fees or expenses.

This chart shows the hypothetical growth of $100 invested in a Taxable and Tax-Deferred Investment over 10 years with an annual return of 7.8%. Performance represented by a standard balanced portfolio represented by 60% Russell 3000 index and 40% Bloomberg US Aggregate Index average ten-year return (7/1/2014 to 6/30/2024). Tax calculations assume federal tax rate of 22%, a state income tax rate of 6%, that all taxable investment earnings are paid annually, and that state taxes are not federally deductible. This illustration is for informational or educational purposes only and does not constitute advice. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any any specific course of action. Be sure to consult your legal or tax professional for tax advice.

The Russell 3000® Index measures the performance of the largest 3,000 US companies designed to represent approximately 98% of the investable US equity market. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market.↩

Flexible spending

An MESP account can be used to pay for a wide range of qualifying educational expenses. Plus, you can withdraw money as needed for qualified expenses and even transfer funds to eligible beneficiaries at no cost.

- Use your savings at colleges, universities, trade schools and community colleges, at graduate or post-graduate schools, professional programs, apprenticeships and more.4

- Pay for tuition, fees, computers, textbooks, room and board or off-campus rent, and other required expenses.

- Pay for qualifying K-12 expenses.4

- Use your funds at eligible institutions in-state or anywhere in the world!

- Even use for student loan repayment subject to a lifetime limit of $10,000 per individual.4

Low fees and expenses

Saving for college for your child shouldn’t break the bank. That’s why investment expenses for the Michigan Education Savings Program are less than a quarter of the average 529 plan fees and less than half of what you’d pay for a broker-sold plan.5

When you open an account, you can enjoy a variety of no-cost perks like:

- NO application fees

- NO cancellation fees

- NO change–in–beneficiary fees

- NO change–in–investment-options fees

- NO loads or sales charges

- NO commissions

- NO transfer fees

Investment options

The Michigan Education Savings Program offers a variety of professionally managed investment options to fit your life situation, risk tolerance and college savings goals. So, whether you’re a new or experienced investor, prefer to be hands-on or would rather “set it and forget it,” there’s a plan for you!